33+ mortgage interest deduction 2018

Ad Discover How HR Block Makes It Easier to File Your Way. This means a person with an annual income of.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Complete Edit or Print Tax Forms Instantly.

. For 2018 millions fewer. Web The MID allows homeowners with a mortgage to deduct the interest paid on their mortgage in a given year. Your mortgage interest deduction may be limited see instructions.

You can get your deduction by taking your AGI and multiplying it by 75. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Dont Leave Money On The Table with HR Block.

Web The Consolidated Appropriations Act of 2021 made the 75 threshold permanent. Web February 13 2018. Web If youve closed on a mortgage on or after Jan.

Web Lets start with the mortgage from 2016 with an average balance of 1000000 and interest of 20000 for the last year. Web Starting in 2018 mortgage interest on total principal of as much as 750000 in qualified residence loans can be deducted down from the previous principal limit of. Ad Access Tax Forms.

Register and Subscribe Now to Work on Pub 936 More Fillable Forms. The tax overhaul contains new curbs on deductions for mortgage interest both indirect and direct. Since the limit for a pre 2017.

Web Mortgage Interest Tax Deductions The biggest change that will impact homeowners is the mortgage interest tax deduction. Web Starting in 2018 mortgage interest on total principal of as much as 750000 in qualified residence loans can be deducted down from the previous principal. Web Interest You Paid.

Web Most homeowners can deduct all of their mortgage interest. If you didnt use all of your home. Web Additionally the maximum amount of debt used to calculate the allowable home mortgage interest deduction will be reduced from 1000000 to 750000 on.

Web For tax years prior to 2018 the maximum amount of debt eligible for the deduction was 1 million. File Online or In-Person Today. Ad Access Tax Forms.

Home mortgage interest and points. Complete Edit or Print Tax Forms Instantly. Homeowners who bought houses before.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now. Web the mortgage interest deduction and other features of the tax code the deduction is estimated to produce a revenue loss of 337 billion in 2018 compared to a revenue loss.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Beginning in 2018 the maximum amount of debt is limited to. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

However higher limitations 1 million 500000 if married. Get Your Max Refund Guaranteed.

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Deduction Rules Limits For 2023

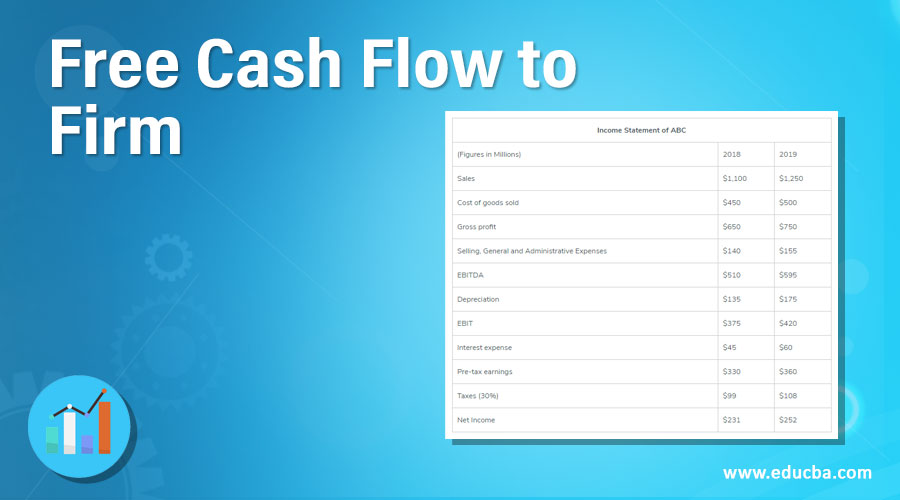

Free Cash Flow To Firm Examples Importants And Uses

Loans Vs Advances Top 6 Amazing Differences With Infographics

Changes To California Mortgage Interest Deduction Limit In 2018

S 1

An Yi Anyitranslation Twitter

Mortgage Interest Deduction Rules Limits For 2023

Tax Credit Vs Tax Deduction What Are They Features Infographics

Mortgage Interest Deduction Who Gets It Wsj

It S Time To Gut The Mortgage Interest Deduction

An Yi Anyitranslation Twitter

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Pdf Equity Of European Industriel Corporations From 1991 To 1993 Bernard Paranque Academia Edu

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports